Population, property and your Nest Egg

By proceeding you confirm that you are a resident of Australia or New Zealand accessing this website from within Australia or New Zealand and you represent, warrant and agree that:

- you are not in the United States or a “U.S. person”, as defined in Regulation S under the U.S. Securities Act of 1933, as amended (“U.S. Person”), nor are you acting for the account or benefit of a U.S. Person;

- you will not make a copy of the documents on this website available to, or distribute a copy of such documents to, or for the account or benefit of, any U.S. Person or any person in any other place in which, or to any other person to whom, it would be unlawful to do so; and

- the state, territory or province and postcode provided by you below for your primary residence in Australia or New Zealand are true and accurate.

Unfortunately, legal restrictions prevent us from allowing you access to this website. If you have any questions, please contact us by e-mail by clicking on the link below.

Australia’s population passed the 25 million mark this year… cause for celebration or regret?

And, importantly how does population growth affect the average investor saving for retirement or anyone who is already retired?

Recently the issue of immigration and population has been making headlines and generating public discussion. In NSW there have been calls to lower immigration and this prompted a federal offer to assist population strain through investing in services and infrastructure, while cutting the immigration rate further wasn't on the radar.

Remarkably, until recently, the issue of our nation’s population received relatively scant public attention.

Many people would be surprised to learn that population growth is one of the key drivers of economic growth and indeed of Australia’s world record breaking streak of more than 26 years of uninterrupted economic growth.

The link between population growth and economic growth is well established and well recognized by economists but less so among the general public.

It is one of the contributing reasons for the continued strong performance of Australian commercial property, but more on this later.

The UBS Australian economics team of George Tharenou, Scott Haslem and Jim Xu noted in a 2016 research paper:

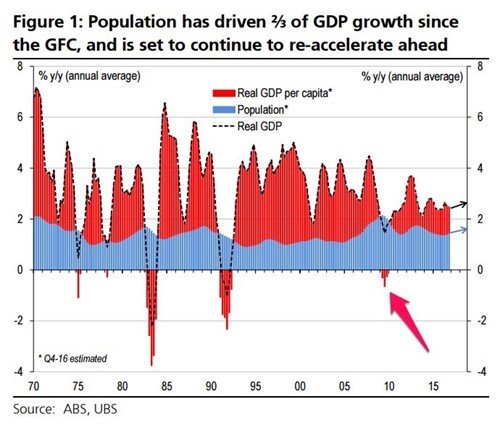

“Since the GFC, (Australian) population growth which has averaged 1.6% - twice the OECD average - contributed two-thirds of GDP growth (averaging 2.4% year on year), double its contribution in the prior 15 years,”

The graph below shows the pivotal and indeed steady contribution of population growth to GDP growth.

In April this year a joint research paper by the Federal Treasury and Department of Home Affairs argued that maintaining our current migration program will add up to 1% to annual average GDP growth because it limits the economic impact of the ageing population.

It’s somewhat remarkable therefore that Australia doesn’t have an official population policy, but we do now have a minister for Population, namely, Alan Tudge, who is Minister for Cities, Urban Infrastructure and Population in the new Morrison Government.

We do however seem to have had a de facto population policy for some time. It’s one that has been bipartisan, in that both major sides of politics supported the current immigration intake cap of 190,000 people per year, which makes up around 60% of the annual population increase.

Importantly, in recent days Minister Tudge would not rule out a further reduction on the current lower permanent migration intake of 162,000 - down from 184,000 in the previous year - when pressed on the issue by the Australian newspaper (October 9, 2018).

So the issue of ‘population’ - policy or no policy - has moved to the front burner of politics. Hopefully it will be the subject of informed debate and not simply emotional point scoring.

It’s still a fair bet that any near-term change to policy would be at the margin, and politically driven, rather than as a result of a revised view on the economic impacts of population growth.

As our population grows there are number of major changes occurring below the surface of the headline figures. Most notable, of course, is the significant demographic change due to an ageing population. By mid-century there will be twice as many of us over the age of 65 and four times as many over 85.

High profile demographer Bernard Salt predicts Melbourne will reach 8 million by 2050 and will become Australia’s biggest city by 2030.

The implications of strong population growth are vast. One of the more visible is that mass transit increasingly is the way of the future for Sydney and Melbourne, with infrastructure projects in both cities reflecting this.

How does our recent economic history and current growth outlook affect current nest egg builders?

Put simply, strong population growth is a real positive for the Australian commercial property sector. This is what we at Charter Hall specialise in: the purchase, development and management of investment-grade commercial property on behalf of small and large investors.

We have developments across all major capital cities to assist with the growing space requirements in key markets and we actively work with policy makers to address the needs of a growing population, workforce and economy.

As the fourth largest owner of Australian institutional office property, second largest owner of industrial property and largest owner of convenience based shopping centres, and Bunnings stores, we recognise population is a key driver in the underlying performance of commercial property.

Our ‘charter’, in short, is to enable ordinary Australians to invest in high quality commercial property. They can invest in our direct (unlisted) property funds in their personal name, thorough an investment trust or via their super or SMSF. Charter Hall Direct currently has four funds open for investment, namely:

- Direct Office Fund (DOF)

- Direct Industrial Fund No.4 (DIF4),

- Direct PFA Fund (PFA), and

- Direct Diversified Consumer Staples Fund (DCSF)

The current projected annual income distributions of these funds range from 5.8%pa to 6.9%pa with distributions paid either monthly or on a quarterly basis.1 Attractive figures in a low-yield environment.

1 DOF’s yield based on the expected distribution for DOF of 8.25 cpu (annualised) for the quarter commencing 1 July 2018, and a unit price of $1.41 as at 1 July 2018. The expected distribution reflects an increase to the 8.00 cpu (annualised) distribution paid in the previous quarter. DIF4’s yield based on actual distribution of 6.50 cents per unit (annualised) for the June 2018 quarter and $1.05 unit price at 1 July 2018. DCSF’s yield based on actual distribution of 6.75 cents per unit (annualised) for the June 2018 quarter and $1.01 unit price at 1 July 2018. PFA’s yield based on actual distribution of 7.25 cents per unit (annualised) for the June 2018 quarter and $1.05 unit price at 1 July 2018.